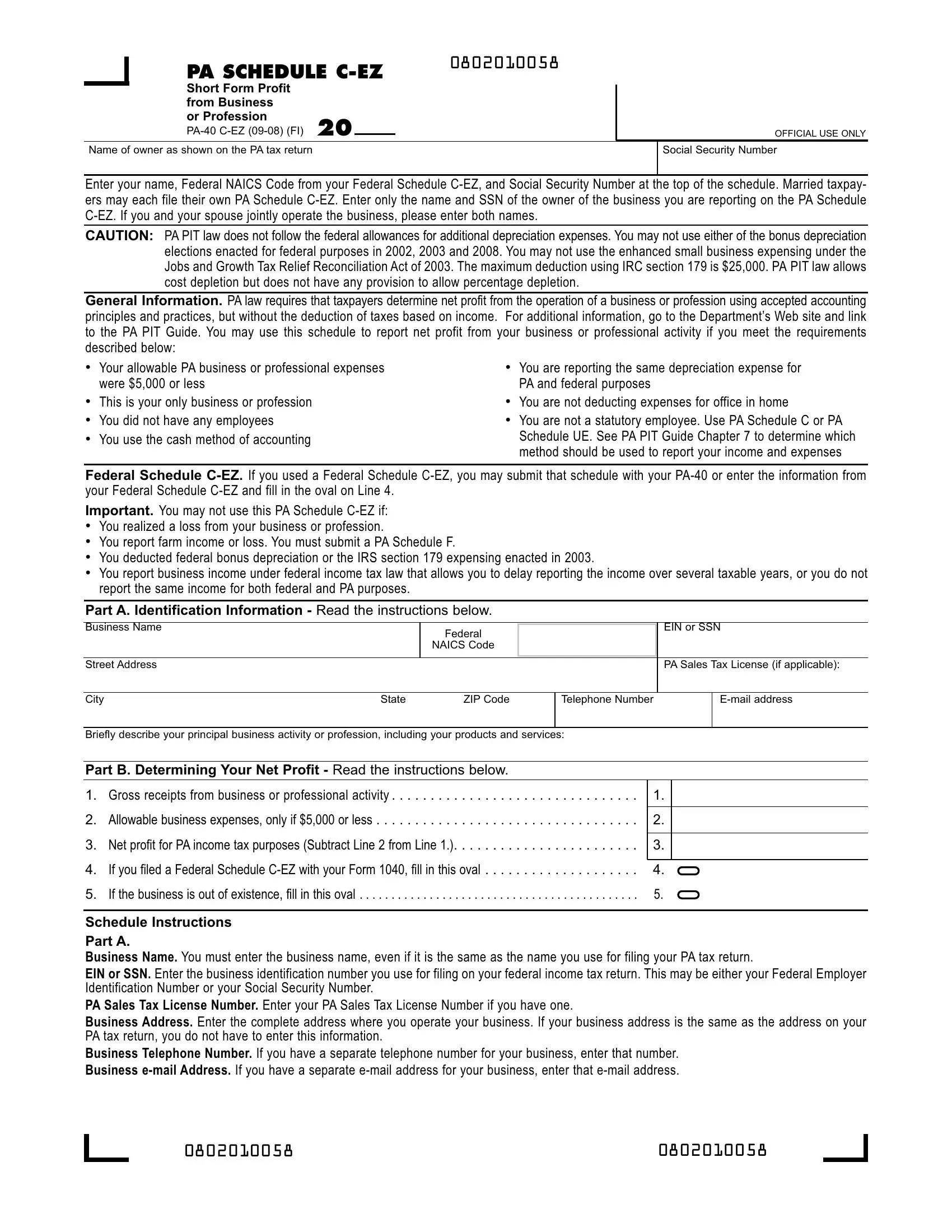

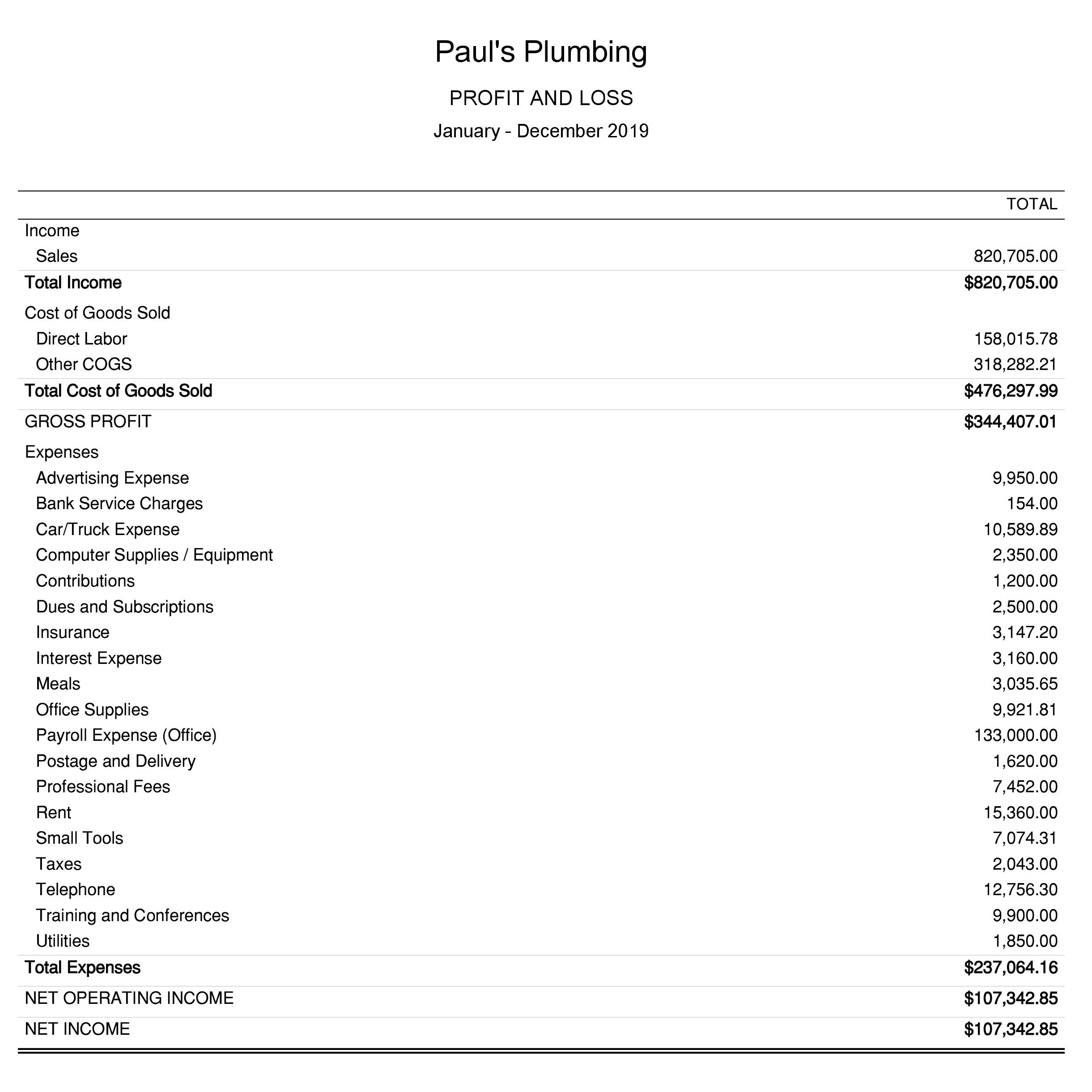

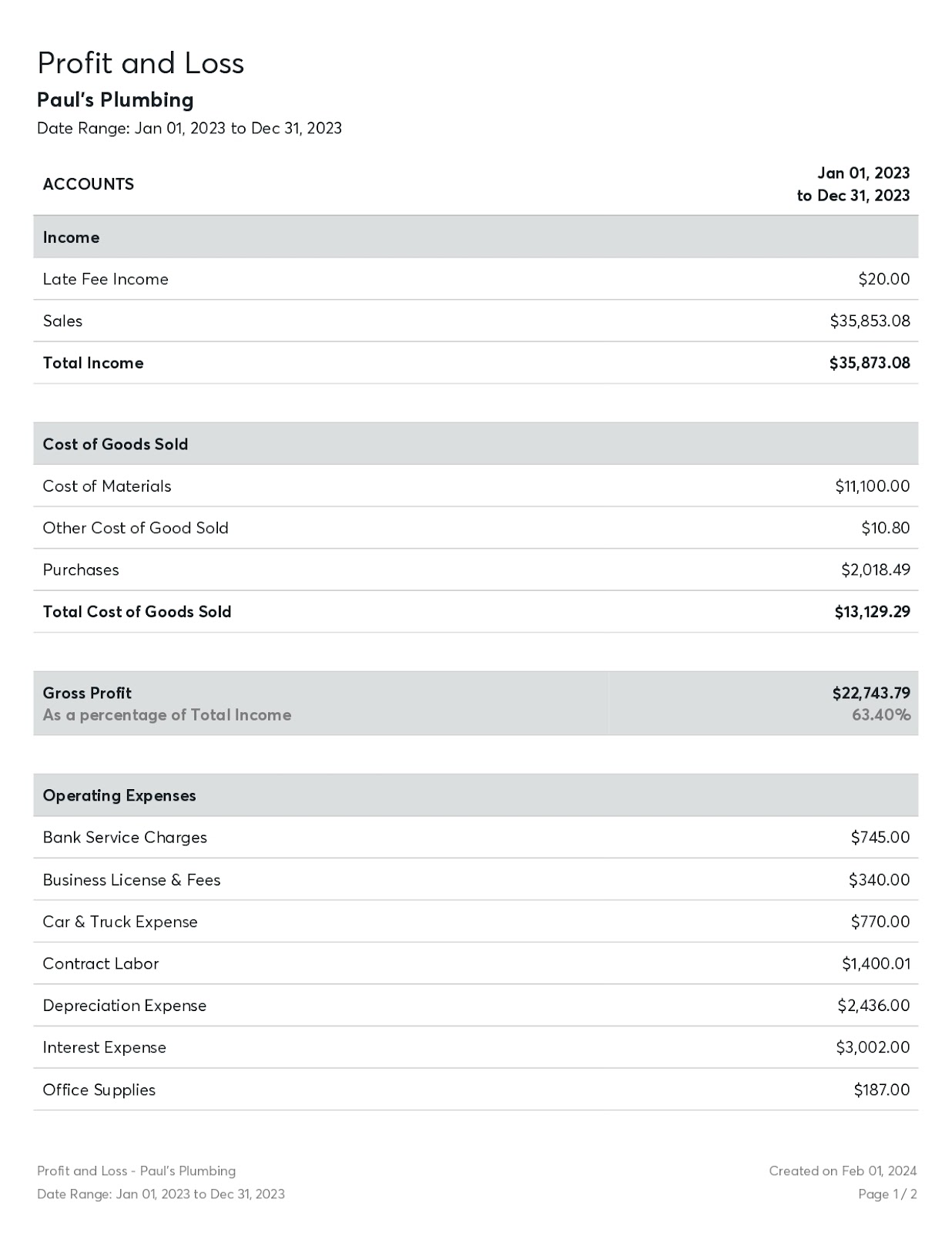

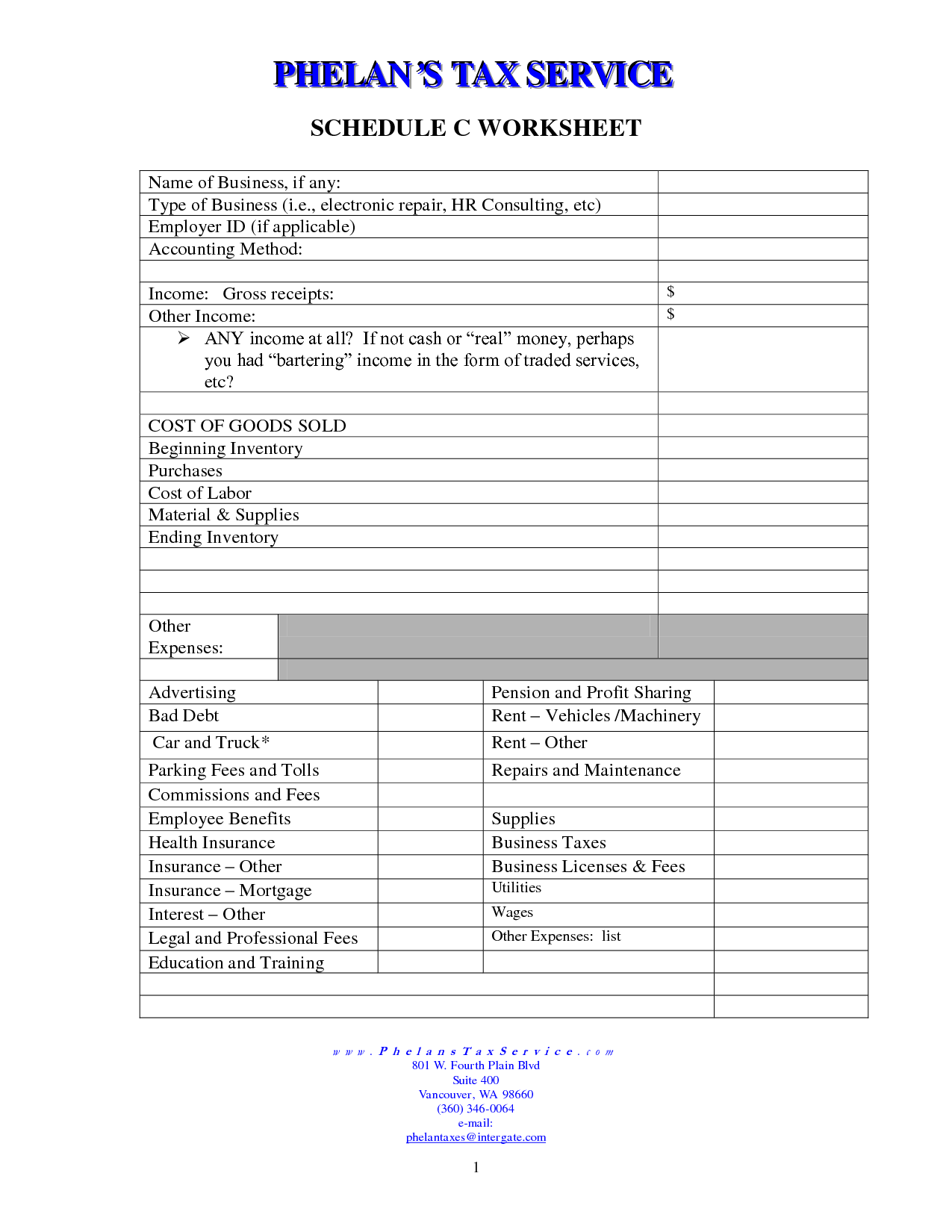

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Is Big Meech And Terry Still In Jail

- Busted Howard County Indiana

- Charlie Fnaf

- New Lyft Driver Bonus

- Aquarius Horoscope Astrotwins

- Medical Coding And Billing Remote Jobs

- Illini Basketball Schedule

- Virginia Lottery Millionaire Raffle

- What Is Planet Fitness Startup Fee

- Navy Chief Selection

- What Is Label Delivery Outbound

- The Galesburg Register Mail

- Greenville Sc Car Taxes

- Metropolitan Funeral Home Portsmouth Va

- Fountain Of Legend Merge Dragons

Trending Keywords

Recent Search

- Mha Archive Of Our Own

- Spectrum Appointment

- Mugshot Chicago

- Sdn Allopathic

- Kay Jewelers Comenity

- Aiken County Arrests Mugshots

- Nearest Spectrum Store

- Mo Hwy Patrol Arrest Report

- Fivebelow Careers

- Fed Ex Location

- Wolfe Bayview Funeral Home Foley Chapel Obituaries

- Zillow Chetek Wi

- Mark 16 Enduring Word

- Fedex Order Prints

- Vacp Treas Benefits

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)