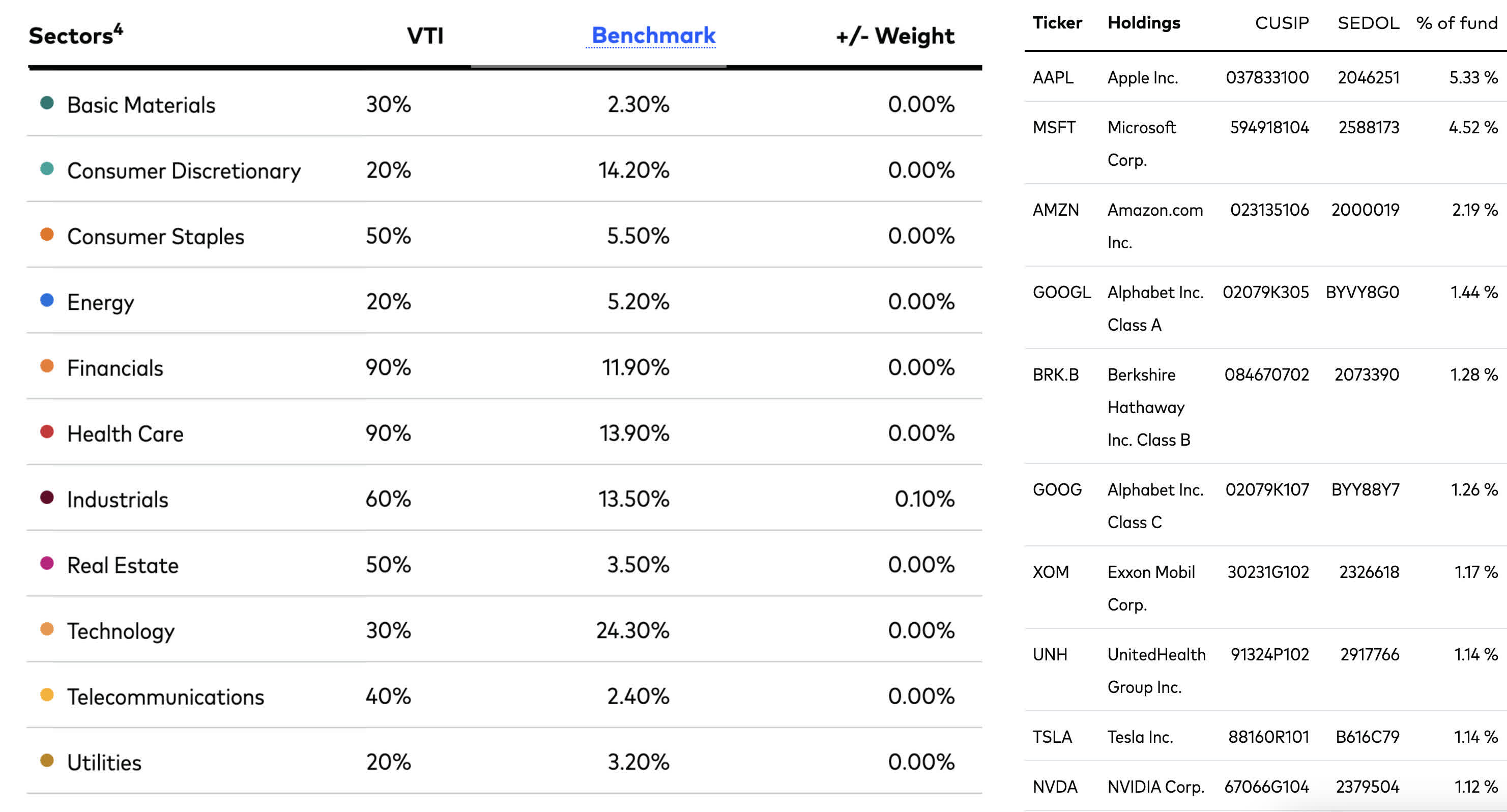

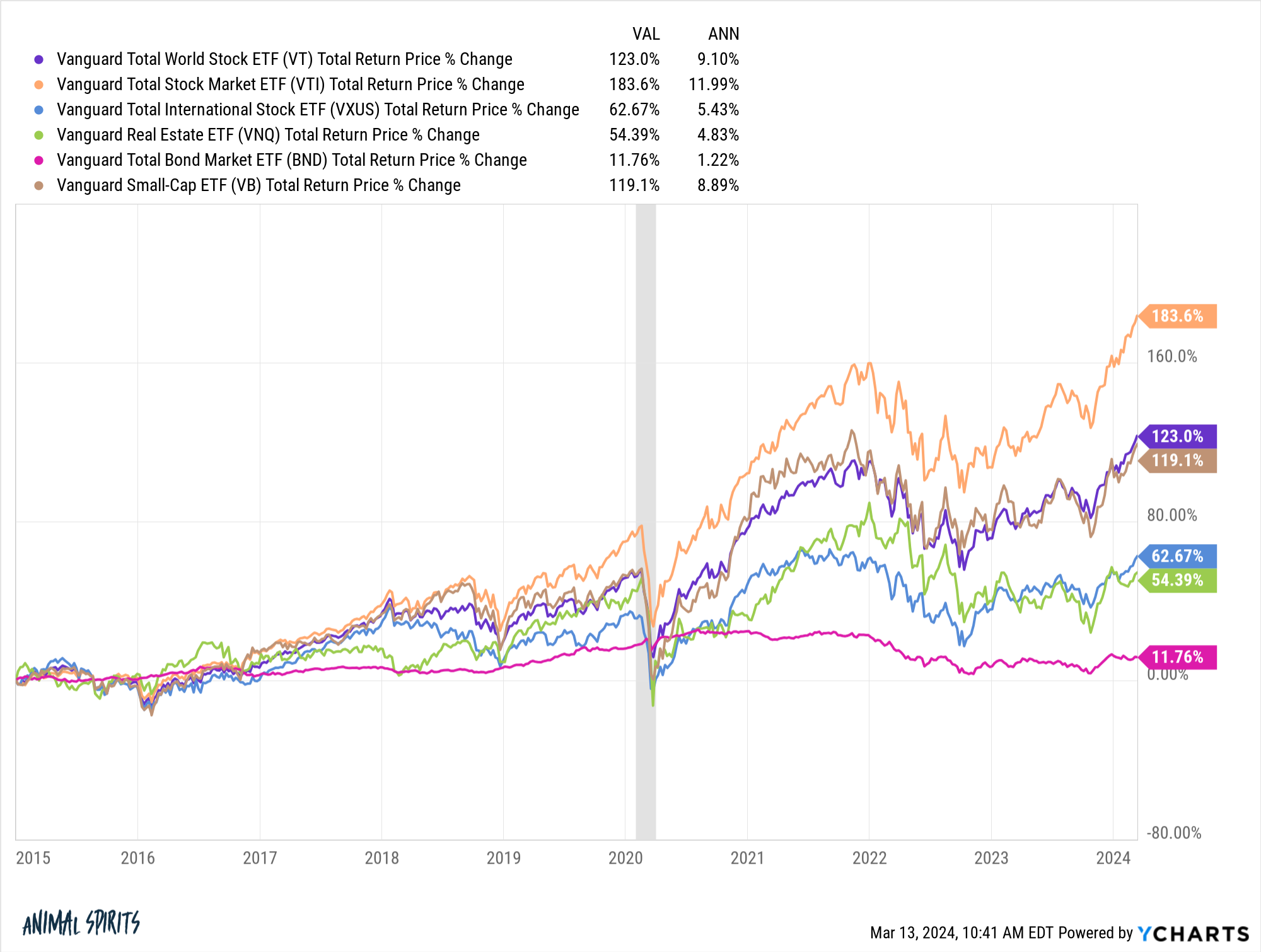

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Jasmoray Baugh Volusia County

- Federal Way Crime Map

- Townhomes For Rent By Private Owner

- India Vogue Daily Horoscope

- Eft Biggest Money Case

- Funcom Forums Conan Exiles

- Quincy Ledger Obituaries

- Jp Holley Funeral Home Obits

- Chris Gallo Arrested

- Landscaping Stone At Menards

- Home Youtube

- Fedex Freight Job Openings

- Who Is The Actress In The Skyrizi Commercial

- Blues Brothers Movie Wiki

- When Does Emory Regular Decision Come Out

Trending Keywords

Recent Search

- Rtro Bowl

- Chime Card Limits

- Monroe Times Obituaries Times

- Northeastern Early Action Release Date

- Crystal Store Nearby

- Obituaries Charlottesville Va

- Chevrolet Tahoe Autotrader

- Justia Us Supreme Court

- Metal Christmas Tree Collar Hobby Lobby

- Bfb 14 Recommended Characters

- Jobs Paying 80k A Year Near Me

- Morgan And Nay Funeral Home Obituaries

- Saline County Kansas Booking

- Dhl Jobs Warehouse

- Venus Transiting 6th House

_14.jpg)